Fill out the form to request information and quotes about any of our services.

At IR Capital we share economic-financial concerns with people, the self-employed and SMEs regarding the assessment of their situation and the definition of future scenarios. Once the person (personal finances) or the company (family office or company) decides where to focus their project, we accompany them in its execution to ensure correct execution and thus obtain the best results.

We complement financial advice with our financial training area, providing sessions and courses for specific company teams (boards of directors, managers or employees) or groups of people (finance course for women, finance course for young people).

In the case of companies whose chosen scenario is going public, we advise them throughout the entire process: design of the operation, choice of suppliers and negotiation of the conditions. Once listed, together with the board of directors, we design the long-term strategy in the capital markets and the “equity story”. Managing externally or providing active support in the area of Investor and Shareholder Relations, as well as Corporate Communication.

Each associate of the firm has more than 15 years of experience in management positions in large corporations, as well as in companies in the growth and acceleration phase. As well as financial advice and training.

Our own system in each of the services offered to our clients has enthusiastic and personal references, as well as endorsements from all types of client profiles: industrial, technological and service companies, both owned by private funds and listed. From the business field and the real estate sector. As well as from investors and individual entrepreneurs.

We respond to the needs of each customer. We want to help you.

Because of our results and our approach, integrated and committed to our values and the concerns of each of our customers.

Because of our high degree of specialization performing uncommon tasks in the market that are essential to highlight the real value of the company, bring closer the interests of companies and the market, and raise funds to grow on a recurring basis

Because each member of our team has an individual success track as a recognized expert in its area, and adds its talent in projects designed ad-hoc to respond to the specific needs of each client, maintaining their independence and objectivity at all times.

Because we really want to help you.

In a first phase we make a diagnosis of the company, fund or SOCIMI (valuation 360º) that translates into a project plan.

In a second phase, the improvement plan is implemented, and in the third phase the round of financing or investment in the private / stock market (Alternative Market – MAB – or Continuous Stock Exchange – Ibex -) is launched.

Our services focus on developing a response to various challenges related to the following areas:

1. Strategy: Valuation and branding.

2. Financial Valuation.

3. Investor Relations: Investor targeting and reporting.

4. Analyst coverage and road shows with investors.

5. Regulatory Compliance.

6. Corporate Communication and Reputation.

If you want your company to grow, contact us: info@ircapital.es

Investor Relations. Corporate Communication.

Investor relations. Investor road shows.

Investor relations.

![]()

Investor relations. Design of stock market strategy (M&A). General shareholders meeting. Coordination global capital increase.

![]()

Quarterly results presentations

Investor relations and regulatory compliance.

Global coordination listing in Alternative Stock Market “MAB”. Investor relations. Company valuation.

Coordination financing round. Investor relations and shareholders.

Investor relations and shareholders. Corporate financial communication. Regulatory compliance.

Coordination global listing Alternative Stock Market “MAB”. Investor relations and shareholders

Private placement advice before listing in Alternative Stock Market ”MAB”.

Investor relations. Financial communication.

BARCELONA

Plaça de Gal-la Placídia, 5 – 7, planta 12

08006 – Barcelona

info@ircapital.es

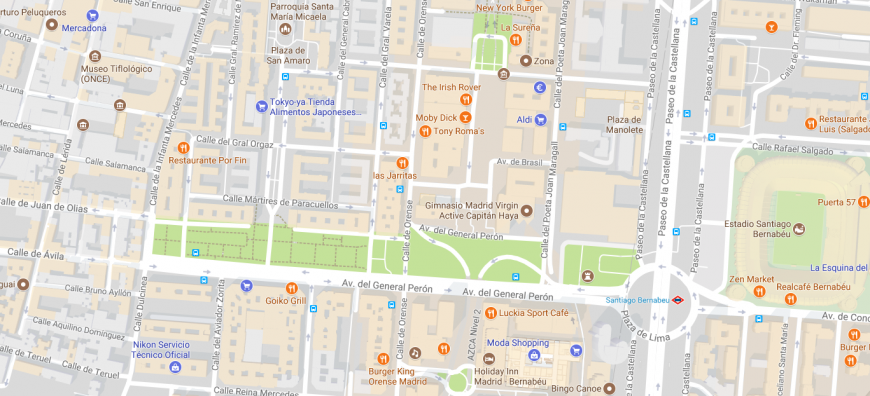

MADRID

C/ del Capitán Haya, 1

28020 – Madrid

info@ircapital.es

Fill out the form to request information and quotes about any of our services.

Plaça de Gal-la Placídia, 5-7, Planta 12 | 08006 Barcelona | info@ircapital.es | +34 654 10 59 55 | Copyright © 2016-2018 - IR Capital | Aviso legal